Maryland State Retirement System

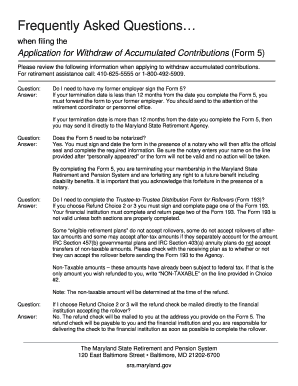

Maryland state retirement system. A new law passed by Maryland will force its state retirement system to reveal the true amount it pays outside managers in fees. State and participating municipal employees and personnel of Maryland public schools public libraries and affiliated State universities and colleges who were enrolled prior to January 1 1980 and who have elected to remain a member of the Retirement System. Details of the plan include.

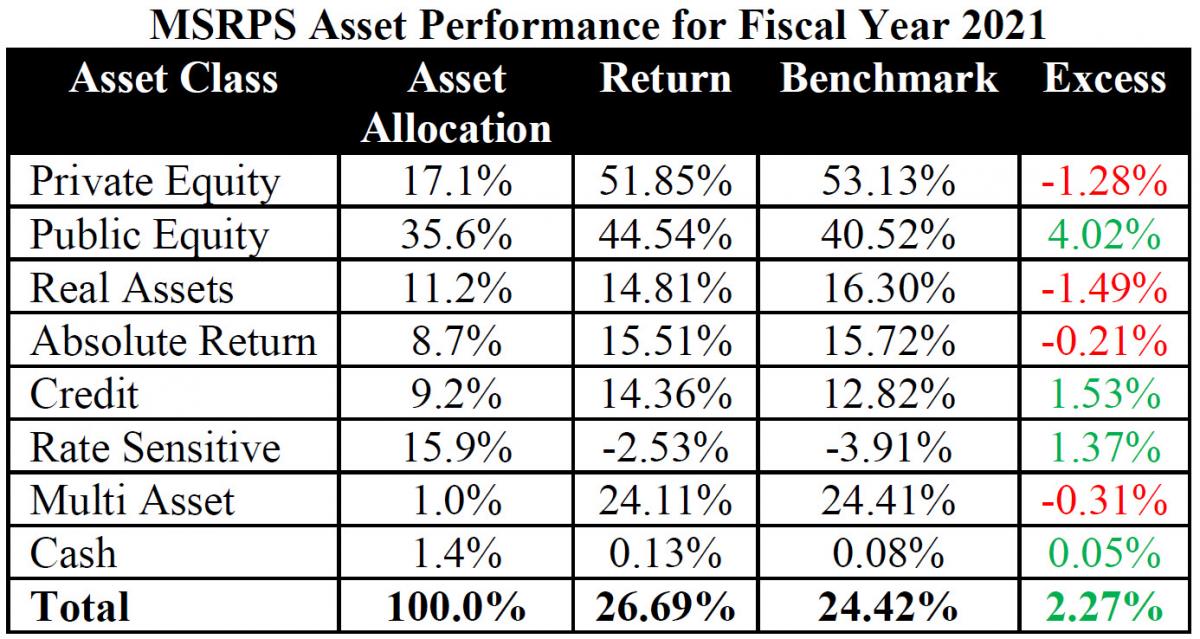

Current Assets for Maryland State Retirement and Pension System is 60592412000 and SWFI has 4 periods of historical assets 5 subsidiaries 134 transactions 2 OpportunitiesRFPs 15 personal contacts available for CSV Export. Maryland State Modified TeachersEmployees Pension System MSPS The Maryland State Pension System is a defined benefit plan. Maryland State Retirement and Pension System.

All active members of the system current employees will continue to accrue service credit during the emergency closures of schools. Under Maryland law established businesses that use an automatic payroll system are required either to offer a retirement plan or to sign their employees up for the MarylandSaves program. Kopp State Treasurer Chair chosen by Board in June 1-year term Peter V.

The State Retirement and Pension System or SRPS or the System. Save on international fees by using Wise which is 5x cheaper than banks. Election to Transfer Service Between Systems Within the Maryland State Retirement and Pension System.

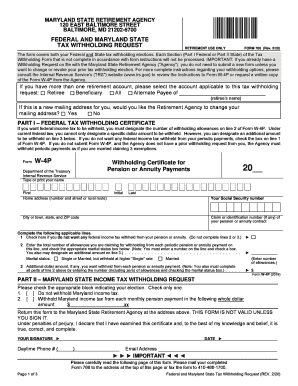

All calendar year 2020 tax statements for payees of the Maryland State Retirement and Pension System were mailed no later than January 29 2021. Larry Hogan requires the Maryland State Retirement and Pension System SRPS to begin reporting annually the amount of carried interest it pays on any assets in the system. Franchot Comptroller of Maryland Vice-Chair chosen by Board in June 1-year term.

Employees and Teachers Retirement System. Under Maryland law established businesses that. Enrollment into the Pension Plan upon hire is irrevocable.

Businesses that do so will receive 300 per year via a waiver of the Maryland business annual filing fee. SWIFT Code BIC.

Spearheading the transition for internal management of.

The State Retirement and Pension System or SRPS or the System. Current Assets for Maryland State Retirement and Pension System is 60592412000 and SWFI has 4 periods of historical assets 5 subsidiaries 134 transactions 2 OpportunitiesRFPs 15 personal contacts available for CSV Export. Save on international fees by using Wise which is 5x cheaper than banks. The State Retirement and Pension System or SRPS or the System. All calendar year 2020 tax statements for payees of the Maryland State Retirement and Pension System were mailed no later than January 29 2021. For retirees under the Local Fire and Police System and Employees Non-Contributory Pension System the annual COLA is calculated using the initial retirement allowance. All active members of the system current employees will continue to accrue service credit during the emergency closures of schools. Under Maryland law established businesses that use an automatic payroll system are required either to offer a retirement plan or to sign their employees up for the MarylandSaves program. Maryland State Retirement and Pension System.

All calendar year 2020 tax statements for payees of the Maryland State Retirement and Pension System were mailed no later than January 29 2021. Challenges experienced by the US Post Office however have caused a delay in delivery for some payees. Oct 2019 - Present2 years 2 months. Employees Retirement System membership on July 1 1994 subject to exceptions. All members except Judges and Legislators. MARYLAND STATE RETIREMENT AND PENSION SYSTEM BALTIMORE MD SWIFT Code Information. Maryland State Retirement and Pension System Maryland State Retirement and Pension System is a Public Pension located in Baltimore MD United States North America.

Post a Comment for "Maryland State Retirement System"